The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures.

The ASU expands the income tax rate reconciliation disclosure and income taxes paid information to address investor requests for more transparent income tax disclosures.

The amendments apply to all entities subject to income taxes, with certain disclosure requirements only applicable to public business entities (PBE).

Key Provisions

During the FASB’s 2021 agenda consultation process, investors expressed concern that existing income tax disclosures don’t provide sufficient information to understand the tax provision for an entity that operates in multiple jurisdictions. According to feedback received by the FASB, investors want to better:

- Understand an entity’s exposure to potential changes in jurisdictional tax legislation and the ensuing risks and opportunities

- Assess income tax information that affects cash flow forecasts and capital allocation decisions

- Identify potential opportunities to increase future cash flows

Rate Reconciliation Disclosures

Under current generally accepted accounting principles (GAAP), PBEs are required to disclose a reconciliation between the reported income tax expense—or benefit—from continuing operations and the amount computed by multiplying the income—or loss—from continuing operations before tax by the applicable statutory federal income tax rate of the jurisdiction of domicile.

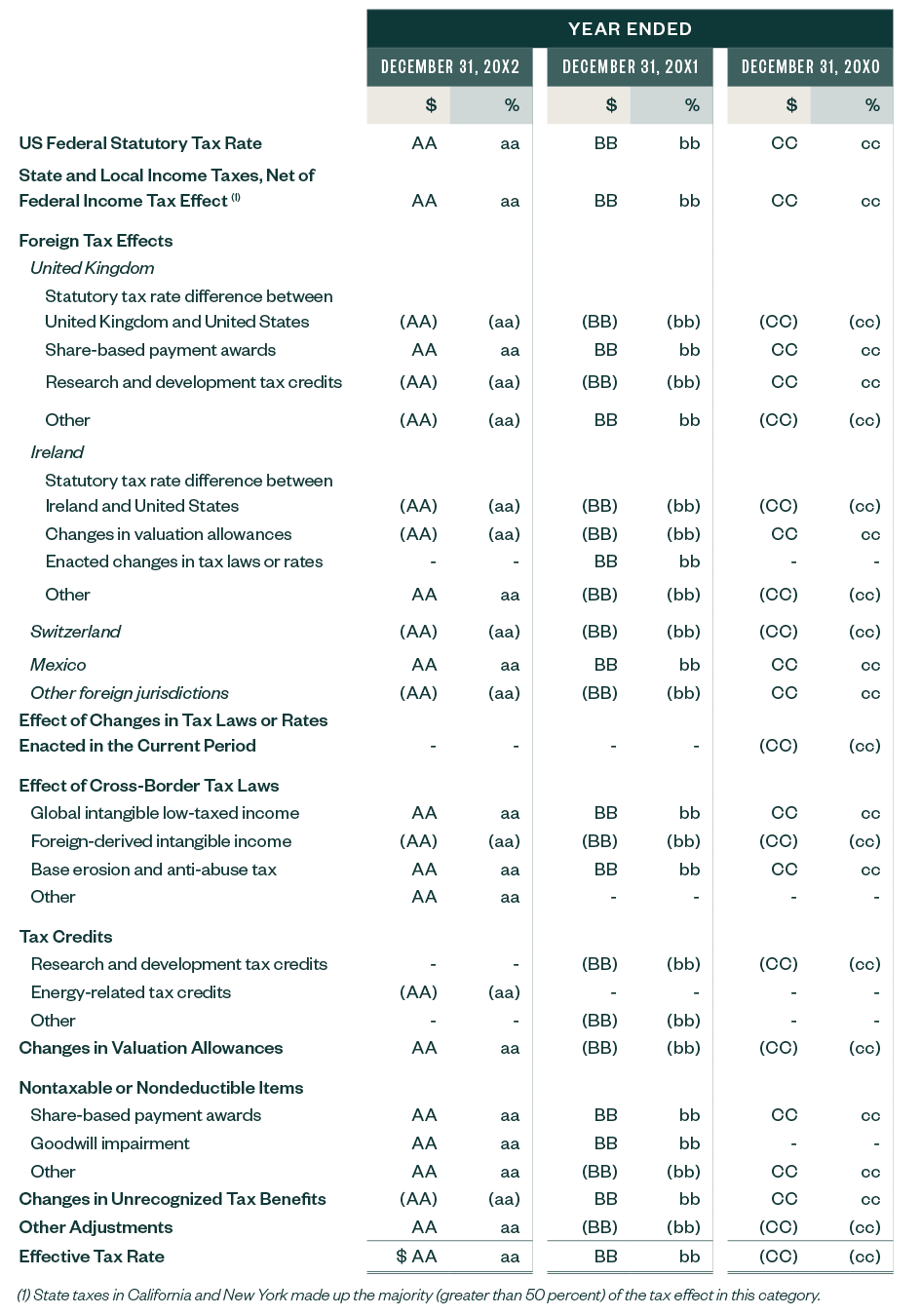

To address investors’ requests for greater transparency, the amendments prescribe the disaggregation of information to be presented in the rate reconciliation. PBEs are annually required to provide a tabular rate reconciliation containing specific categories, using both percentages and reporting currency amounts. Additional information is required for reconciling items that meet a quantitative threshold.

In the tabular rate reconciliation, PBEs are required to disclose the following eight categories:

- State and local income tax, net of federal income tax effect

- Foreign tax effects

- Effects of changes in tax laws or rates enacted in the current period

- Effect of cross-border tax laws

- Tax credits

- Changes in valuation allowances

- Nontaxable or nondeductible items

- Changes in unrecognized tax benefits

For the state and local category, PBEs should provide a qualitative description of the state and local jurisdictions that contribute to the majority, greater than 50% of the effect of the state and local income tax category.

Further disaggregation is required for the following reconciling items in which the effect is equal to or greater than 5% of the amount computed by multiplying pretax income or loss by the applicable statutory federal income tax rate if the reconciling item is within the:

- Effect of cross-border tax laws, tax credits, and nontaxable or nondeductible items categories, it must be disaggregated by nature

- Foreign tax effects category, it must be disaggregated by jurisdiction, or country, and by nature, except for reconciling items related to changes in unrecognized tax benefits, which can be disclosed on an aggregate basis for all jurisdictions

Reconciling items not within any of the eight required categories listed above must be disaggregated by nature.

If not otherwise evident, PBEs should provide an explanation of the individual reconciling items disclosed, such as the nature, effect, and significant year-over-year changes of the reconciling items.

Reconciling items presented are required to be presented on a gross basis, except for reconciling items related to unrecognized tax benefits and the related tax positions and tax effects of certain cross-border tax laws and the related tax credits, which may be presented on the net basis.

The following is an example tabular rate reconciliation that is required for PBEs under the amended guidance:

Entities Other Than Public Business Entities

Nonpublic entities are currently required to disclose the nature of significant reconciling items but may omit a numerical reconciliation.

To improve qualitative disclosures, the amendments require entities other than PBEs to provide qualitative disclosure, including the nature and effect, of specific categories of items and individual jurisdictions that result in a significant difference between the statutory tax rate and the effective tax rate.

Income Taxes Paid Disclosures

To further enhance investor understanding of an entity’s income taxes, the amendments require all entities to disclose the following information about income taxes paid, on an annual basis:

- Amount of income taxes paid (net of refunds received) disaggregated by federal, state, and foreign taxes

- Amount of income taxes paid (net of refunds received) disaggregated by individual jurisdictions in which income taxes paid (net of refunds received) is equal to or greater than 5% of total income taxes paid (net of refunds received)

Other Disclosures in Response to Stakeholder Feedback

All entities are currently required to disclose the nature and estimate of the range of the reasonably possible change in the unrecognized tax benefits balance in the next 12 months or make a statement that an estimate of the range cannot be made. Given the difficulty for entities to reliably predict changes in unrecognized tax benefits over a 12-month period, the amendments eliminate this disclosure requirement.

There’s currently a requirement to disclose the cumulative amount of each type of temporary difference when a deferred tax liability isn’t recognized because of exceptions to comprehensive recognition of deferred taxes related to subsidiaries and corporate joint ventures. Stakeholder feedback indicated that after the enactment of the Tax Cuts and Jobs Act, the existing disclosure requirement has less relevance. The amendments also remove this disclosure requirement.

The amendments add the requirement all entities to disclose the following information:

- Income or loss from continuing operations before income tax expense or benefit disaggregated between domestic and foreign

- Income tax expense or benefit from continuing operations disaggregated by federal, state, and foreign

The amendments also replace the term public entity as currently used under ASC 740 with the term public business entity as defined by the Master Glossary.

Effective Dates

For public business entities, the amendments are effective for annual periods beginning after December 15, 2024. For entities other than public business entities, the amendments are effective for annual periods beginning after December 15, 2025.

Early adoption is permitted for annual financial statements that have not yet been issued or made available for issuance.

Transition Method

The amendments in this update should be applied on a prospective basis. Retrospective application is permitted.

We’re Here to Help

For more information on how your business could be affected by these amendments to income tax disclosures, please contact your Moss Adams professional.